From our friends at the kcm blog

In recent years, there’s been a significant shift in how wealth is distributed among generations. It’s called the Great Wealth Transfer.

Historically, the transfer of wealth from one generation to the next was a more gradual process, often limited to smaller amounts of inheritance or family savings. But today, the scale has increased in a big way. As a recent article from Bankrate says:

“The biggest wave of wealth in history is about to pass from Baby Boomers over the next 20 years, and it’s going to have major impacts on many facets of life. Called The Great Wealth Transfer, $84 trillion is poised to move from older Americans to...

Read More

From our friends at the kcm blog

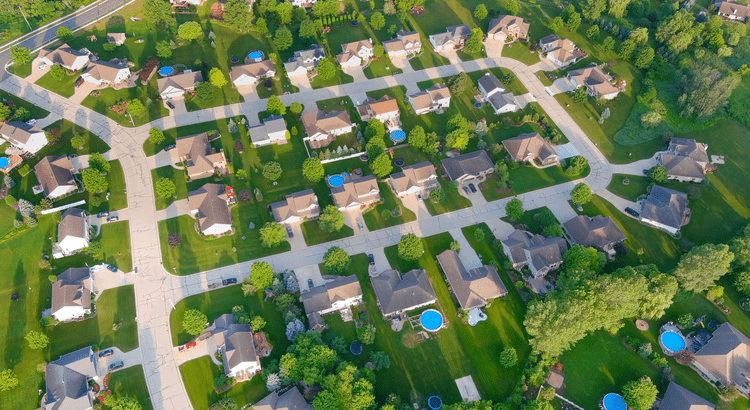

If you’re planning to sell your house and move, you probably know there’s been a shortage of options available. But here’s the good news: the supply of homes for sale has grown in a lot of markets this year – and that’s not just existing, or previously-owned, homes. It’s true for newly built homes too.

So how do you decide which route to go? Do you buy an existing home or a brand-new one? The choice is yours – you just need to figure out what’s most important to you.

Perks of a Newly Built Home

Here are some benefits of buying a newly built home right now:

...

Read More

From our friends at the kcm blog

Curious about selling your home? Understanding how much equity you have is the first step to unlocking what you can afford when you move. And since home prices rose so much over the past few years, most people have much more equity than they may realize.

Here’s a deeper look at what you need to know if you’re ready to cash in on your investment and put your equity toward your next home.

Home Equity: What Is It and How Much Do You Have?

Home equity is the difference between how much your house is worth and how much you still owe on your mortgage. For example, if your...

Read More

From our friends at the kcm blog

Figuring out what to do with your house when you’re ready to move can be a big decision. Should you sell it and use the money for your next adventure, or keep it as a rental to build long-term wealth?

It’s a question many homeowners face, and the answer isn’t always straightforward. Whether you’re curious about the potential income from renting or worried about the responsibilities of being a landlord, there’s a lot to consider.

Let’s walk through some key questions to ask to help you make the best decision for your situation.

Is Your House a Good Fit for Renting?

Even if you’re interested in becoming a...

Read More

From our friends at the kcm blog

The housing market is going through a transition. Higher mortgage rates are causing more moderate buyer activity at the same time the supply of homes for sale is growing.

And if you aren’t working with an agent, you may not realize that. Here’s the downside. If you’re not informed, you can’t adjust your strategy or expectations to today’s market. And that can lead to a number of costly mistakes.

Here’s a look at some of the most common ones – and how an agent will help you avoid them when you sell.

1. Overpricing Your House

Many sellers set their asking price too high and that’s why there’s an uptick in homes with price...

Read More

From our friends at the kcm blog

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what’s ahead.

One thing that can affect mortgage rates is the Federal Funds Rate, which influences how much it costs banks to borrow money from each other. While the Federal Reserve (the Fed) doesn’t directly control mortgage rates, they do control the Federal Funds Rate.

The relationship between the two is why people have been watching closely to see when the Fed might lower the Federal Funds Rate. Whenever they do, that’ll put downward pressure on mortgage rates. The Fed meets next week, and three of the most important...

Read More

From our friends at the kcm blog

Even though data shows inflation is cooling, a lot of people are still feeling the pinch on their wallets. And those high costs on everything from gas to groceries are fueling unnecessary concerns that more people are going to have trouble making their mortgage payments. But, does that mean there’s a big wave of foreclosures coming?

Here’s a look at why the data and the experts say that’s not going to happen.

There Aren’t Many Homeowners Who Are Seriously Behind on Their Mortgages

One of the main reasons there were so many foreclosures during the last housing crash was because relaxed lending standards made it easy for people...

Read More

From our friends at the kcm blog

If you’re thinking about selling your house, you should know there are buyers who are ready and able to pay today’s high prices. But they want a home that’s move-in ready. A recent press release from Redfin explains:

“Buyers are still out there and they’re willing to pay today’s high prices, but only if the house is in really good shape. They don’t want to spend extra money on paint or new appliances.”

It makes sense when you think about it. They’re having to pay a lot of money for a house in today’s market. That means they may not be able to easily afford upgrades after...

Read More

From our friends at the kcm blog

Navigating the housing market can be tricky, especially these days. That’s why having an experienced guide when buying or selling a home is so important. The market isn’t exactly straightforward right now, and working with a real estate expert can offer insights and advice that make all the difference.

While today’s market conditions might seem confusing or overwhelming, you don’t have to handle them alone. With a trusted expert leading you through every step, you can navigate the process with the clarity and confidence you deserve.

Here are just a few of the ways a real estate expert is invaluable:

Contracts – Agents help with the disclosures and contracts necessary in today’s heavily regulated...

Read More

From our friends at the KCM blog

Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it’s important to think about whether your current home still fits your needs.

If it’s too big, too costly, or just not convenient anymore, downsizing might help you make the most of your retirement years. To find out if a smaller, more manageable home might be the perfect fit for your new lifestyle, ask yourself these questions:

Do the original reasons I bought my current house still stand, or have my needs changed since then?

Do I really need and want the space...

Read More