Mortgage Rates Cool Down as the Summer Housing Markets Kicks Off

By Margaret Heidenry|Realtor.com

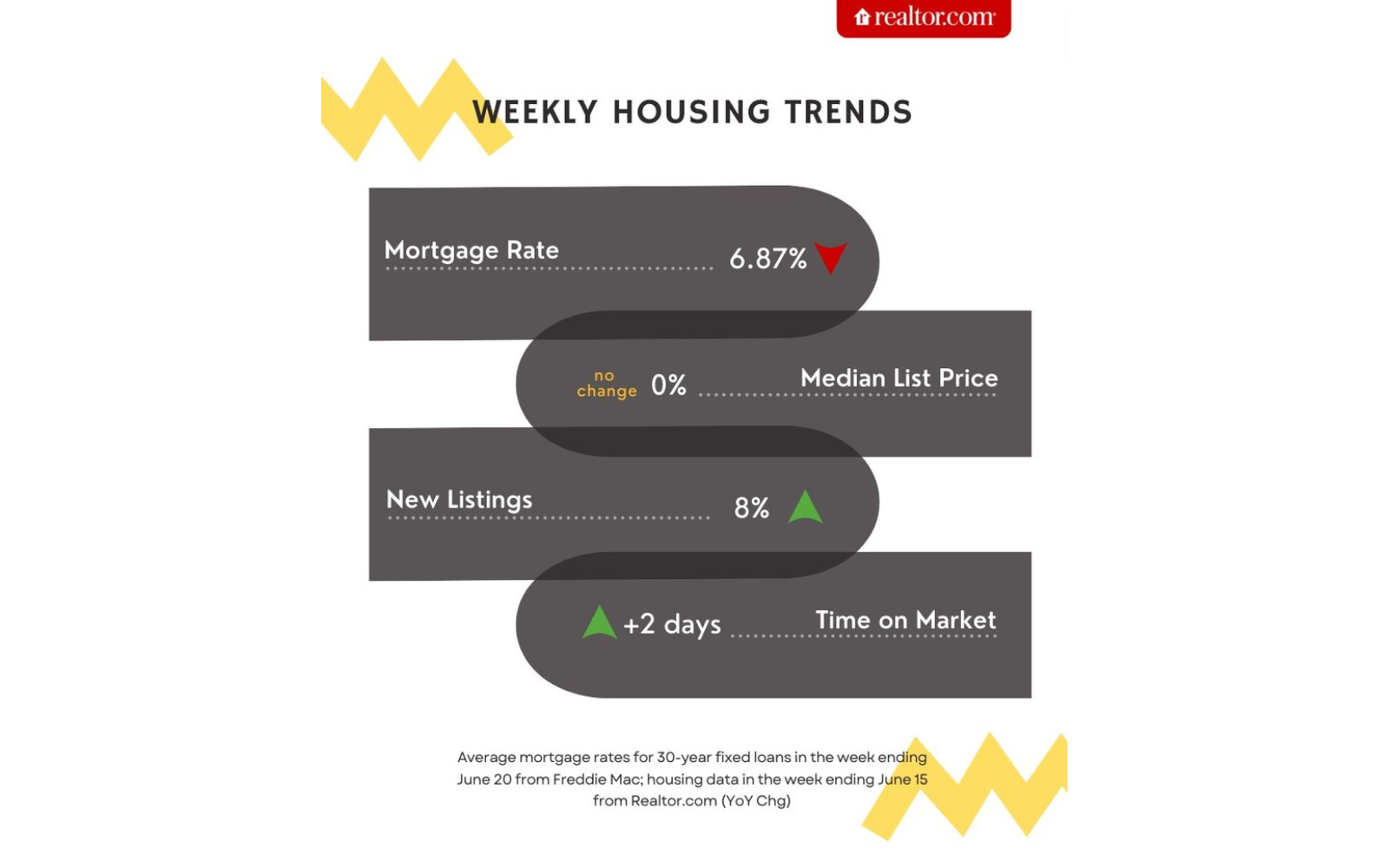

Mortgage rates continued to fall this week, with the average rate for a 30-year fixed home loan sinking from 6.95% last week to 6.87% for the week ending June 20, according to Freddie Mac.

“Mortgage rates fell for the third straight week following signs of cooling inflation and market expectations of a future Fed rate cut,” Sam Khater, Freddie Mac’s chief economist, said in a statement. “These lower mortgage rates coupled with the gradually improving housing supply bodes well for the housing market.”

Mortgage rates have hovered around the 7% mark, fluctuating slightly above and below this benchmark for nearly two months, creating a market largely stuck in neutral.

As a result, the housing market remained remarkably unchanged as spring turned to summer this week, with key metrics like home price and housing stock levels remaining the same as last week.

Does this mean the market is stabilizing or on the brink of change? It all comes down to where mortgage rates eventually land in the coming months.

“A recent survey revealed that a sizable 40% of potential buyers would find a home purchase feasible if mortgage rates were to drop below 6%,” says Realtor.com® data scientist Sabrina Speianu in her latest analysis.

Here’s a breakdown of the latest housing market data and what it means for homebuyers and sellers in our latest installment of “How’s the Housing Market This Week?”

Mortgage rates are unlikely to fall significantly

Buyers and sellers hoping mortgage rates would begin to decline as the summer market heats up are likely in for disappointment.

“In the updated economic projections from the June FOMC meeting, the anticipated rate cuts by the end of 2024 have been scaled back from three to one,” says Realtor.com economist Jiayi Xu. “And to implement this single rate cut, significant progress is still needed before the Fed feels confident enough, as indicated by the strong May job growth and stubborn [consumer price index] data.”

Until rates fall significantly, many sellers are likely to hold on to their existing low rates—and their homes—creating a ripple effect in the housing market.

However, “if the promising inflation readings seen in May continue, it could lead to softening rates and increase in seller interest toward the latter half of the year,” says Speianu.

Housing stock is on the upswing

The good news is that more sellers listed their homes for the week ending June 15 compared with a year prior, with new listings up by 8.0%.

“These past few months, sellers have been particularly sensitive to mortgage rates, with newly listed homes being one of the first metrics to respond to the small fluctuations seen in mortgage rates in recent months,” says Speianu.

Overall inventory increased as well for the week ending June 15, with the total number of homes for sale 36.0% above year-ago levels. This marks a 32-week streak where more homes were listed for sale versus the prior year.

Yet, in the big picture, housing stock is still more than 30% below pre-pandemic levels seen in 2017 to 2019.

Home prices remain flat

The median list price remained unchanged year over year for the week ending June 15, marking the third week in a row of stable list prices. (In May, the median home cost $442,500.)

“In recent months, listing price growth has remained muted as a greater share of more affordable homes were available for sale compared to the same time last year,” says Speianu.

List prices might not be rising significantly, but they aren’t falling, either. The rut all comes down to housing stock, which overall remains below COVID-19 pandemic levels, providing what Speianu calls a “floor to listing prices.”

Yet home prices are cooling off in another way, as the share of homes for sale with price reductions remained above last year’s level for the week ending June 15.

“With greater inventory and a slower time on market, it is possible that price growth might continue to decelerate further until the market sees a meaningful decline in mortgage rates,” adds Speianu.

The pace of the market slows

For the week ending June 15, homes spent two more days on the market than last year. (The average home spent 44 days on the market this May.)

This slight increase in how long a home lingers on the market reflects the ongoing adjustments in the housing market as it stabilizes post-pandemic.

“Inventory continues to grow as time on the market increases slightly compared to the previous year, and sellers continue to list homes at a greater pace than last year, albeit less than seen in the housing market prior to the pandemic,” says Speianu.